How SharkShop Helps You Overcome Credit Setbacks

**Title: How SharkShop Helps You Overcome Credit Setbacks**Are you tired of being held back by credit setbacks that seem impossible to overcome? Whether it’s a missed payment, high debt-to-income ratio, or just the lingering effects of past financial mistakes, rebuilding your credit can feel like an uphill battle.

But what if we told you there’s a powerful ally in your corner ready to help you navigate these turbulent waters? Enter SharkShop.biz a revolutionary platform designed not only to empower individuals facing credit challenges but also to transform those obstacles into stepping stones toward financial freedom.

In this blog post, we'll dive deep into how SharkShop is reshaping the way people tackle their credit issues and rediscover their purchasing power. Get ready to take control of your financial future!

Introduction to SharkShop and its mission

Navigating the world of credit can feel like walking a tightrope. One small slip, and you might find yourself facing unexpected challenges that can shake your financial foundation. Enter SharkShop—a game-changer in the realm of credit recovery. With a mission to empower individuals to reclaim their financial lives, SharkShop.biz offers innovative solutions designed for real people with real setbacks.

Whether you're grappling with past mistakes or just trying to get back on solid ground, this dynamic platform is here to help you turn things around and achieve lasting stability. Let's dive into how SharkShop makes it possible for anyone to overcome credit hurdles and emerge stronger than ever before!

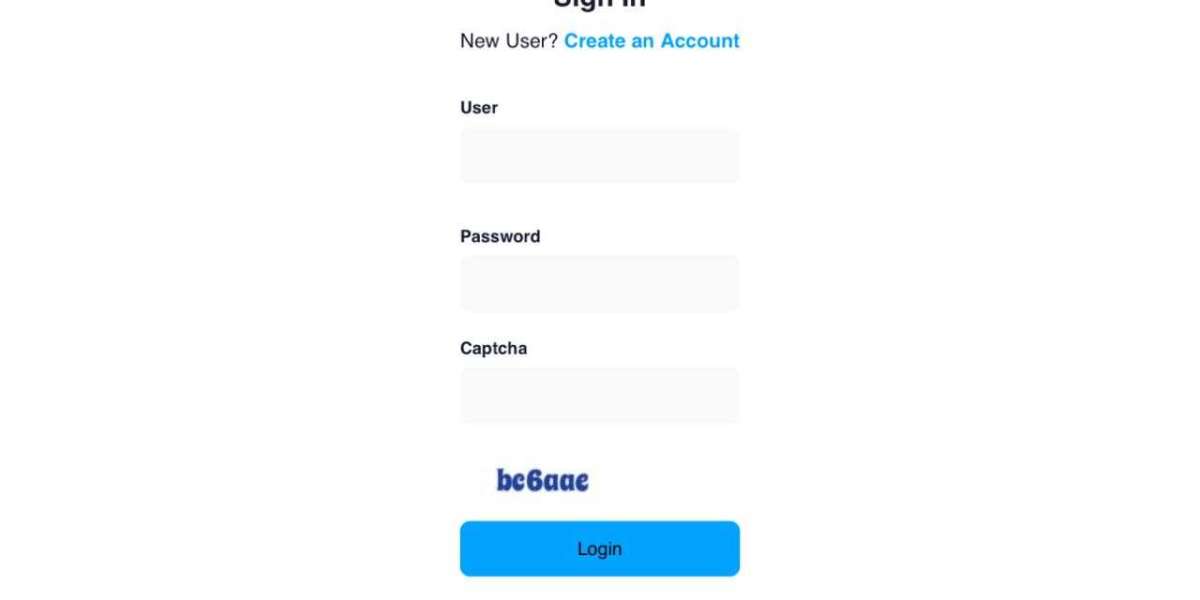

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding credit setbacks and how they can impact financial stability

Credit setbacks can happen to anyone. Life is unpredictable, and financial emergencies often arise unexpectedly. Whether it’s job loss, medical bills, or unexpected repairs, these situations can lead to missed payments and a drop in credit scores.

A low credit score doesn’t just affect your ability to secure loans; it can hinder opportunities for renting an apartment or even securing certain jobs. Many people underestimate the long-term effects of poor credit on their overall financial health.

High interest rates on loans become a reality for those with damaged credit. This leads to higher monthly payments that strain budgets and limit spending flexibility.

Understanding these consequences is crucial. Recognizing how past mistakes impact future opportunities empowers individuals facing similar challenges. It also highlights the importance of seeking help when navigating through difficult financial times.

How SharkShop's services can help individuals overcome credit setbacks

SharkShop offers a range of tailored services designed to help individuals navigate their credit challenges. Whether you're dealing with late payments or high credit utilization, the team at SharkShop understands your unique situation.

Their expert consultants provide personalized assessments that identify specific areas for improvement. This targeted approach helps clients create actionable plans to boost their credit scores effectively.

Moreover, SharkShop offers educational resources that empower users with knowledge about credit management. By learning how to maintain healthy financial habits, individuals can build a stable future.

Additionally, ongoing support is available through regular check-ins and updates on progress. Clients are never left in the dark; they receive guidance every step of the way as they work towards restoring their financial health.

Testimonials from satisfied clients who have used SharkShop's services

Jessica, a recent client, couldn't believe the transformation in her financial situation. After struggling with a low credit score for years, she turned to SharkShop and found support every step of the way. “They genuinely care,” she says. “It felt like I had a partner in my journey.”

Mark shared his experience as well. He faced constant rejections when applying for loans due to past mistakes. With SharkShop's expert guidance, Mark successfully rebuilt his credit profile and secured financing for his small business.

Then there's Sarah, who appreciated the educational resources provided by SharkShop. “I learned so much about maintaining good credit habits,” she mentions. The tools they offered helped her stay on track long after their services ended.

These stories reflect just how impactful SharkShop login can be in helping individuals regain control over their financial futures. Each testimonial reveals hope and renewed confidence among clients ready to move forward.

Tips and advice for maintaining good credit habits after using SharkShop

Maintaining good credit habits is essential after using SharkShop. Start by checking your credit report regularly. This helps you spot any inaccuracies and stay informed about your financial status.

Set up automatic payments for bills to avoid late fees. Timely payments are crucial for a healthy credit score.

Keep your credit utilization low. Aim to use no more than 30% of your available credit limit, as this shows lenders that you're responsible with borrowing.

Consider diversifying your types of credit cautiously. Having a mix can positively impact your score but be mindful not to take on debt unnecessarily.

Lastly, educate yourself continuously about personal finance topics. Knowledge empowers you to make better decisions in the long run and keep potential setbacks at bay.

Frequently asked questions about SharkShop's services and answers from the team

Many people are curious about how SharkShop can assist them. One common question is whether the services suit individuals with varying credit scores. Yes, SharkShop caters to all ranges of credit situations.

Another frequently asked question revolves around the process of getting started. Users simply need to sign up and provide some basic information. The team will take it from there, offering tailored solutions based on individual needs.

Some clients wonder if there are any hidden fees involved in using SharkShop's services. Rest assured, transparency is a top priority at SharkShop; no unexpected costs pop up after you begin.

Lastly, many ask how long it takes to see results. While every situation differs, clients often report noticeable improvements within just a few months of utilizing the resources available through SharkShop cc platform.

Conclusion on how SharkShop is a valuable resource for overcoming credit setbacks

SharkShop.biz stands out as a vital ally for anyone grappling with credit setbacks. With its comprehensive services, the company not only helps individuals navigate their financial challenges but also empowers them to make informed decisions moving forward. The blend of expert guidance and tailored solutions ensures that clients feel supported every step of the way.

By focusing on education and sustainable practices, SharkShop encourages habits that contribute to long-term financial health. Testimonials from satisfied customers serve as proof of its effectiveness, showcasing real-life success stories that inspire hope and action.

Whether you're looking to rebuild your credit score or simply want to learn more about maintaining good credit habits, SharkShop offers resources that can truly make a difference in your financial journey. Embracing these tools means choosing a path toward greater stability and confidence in managing money matters.