Gold continues to be a favored investment for those looking to secure their wealth against economic uncertainties. Among the various sizes available, the 200 gram gold bar offers a balance between larger bulk investments and more manageable pieces. This article explores the factors that influence the 200 gram gold price and why it might be a smart addition to your investment portfolio.

What is a 200 Gram Gold Bar?

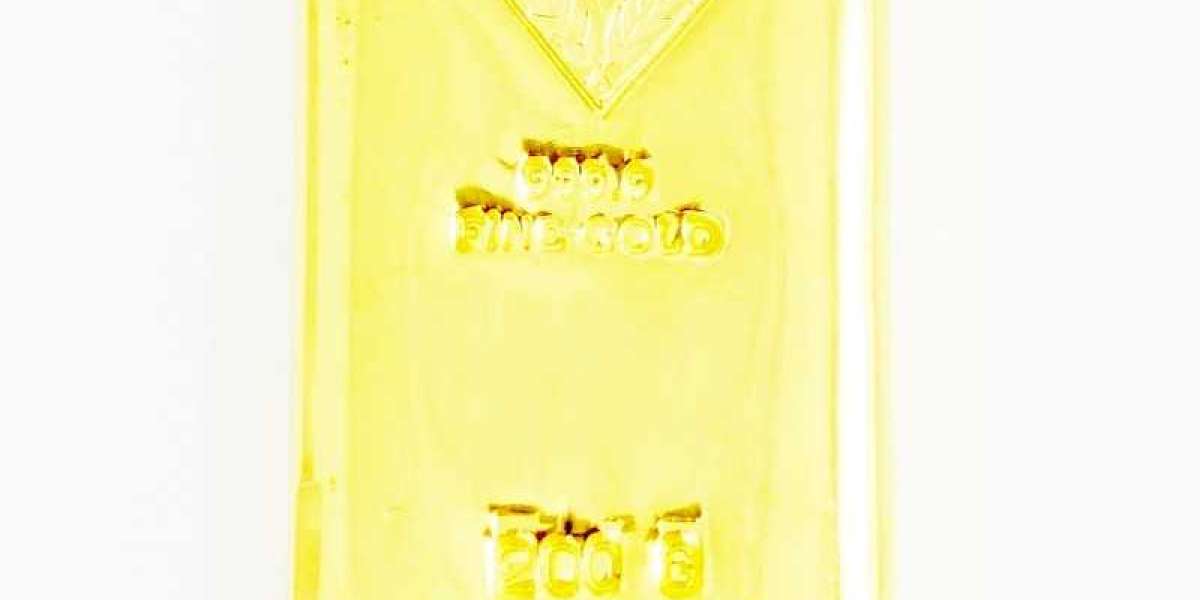

A 200 gram gold bar is a substantial piece of gold that weighs exactly 200 grams. Typically crafted from 24-karat gold (99.99% pure), these bars represent a significant amount of gold and, therefore, value. They are favored by investors who want a balance of size, value, and storage efficiency.

Factors Influencing the 200 Gram Gold Price

Several factors contribute to the pricing of a 200 gram gold bar. Understanding these can help you make informed investment decisions:

1. Spot Price of Gold

The spot price of gold is the current market price at which gold can be bought or sold for immediate delivery. This price fluctuates based on supply and demand dynamics, geopolitical events, economic data, and market speculation.

2. Purity

The 200 gram gold bars are typically made from 24-karat gold, which is 99.99% pure. Higher purity gold commands higher prices.

3. Manufacturer and Brand

The reputation of the manufacturer or mint can influence the price. Well-known and trusted brands often command a premium due to their assurance of quality and authenticity.

4. Premiums and Fees

In addition to the spot price, the cost of a 200 gram gold bar includes premiums and fees. These cover the costs of production, distribution, and the dealer’s margin. Premiums may vary depending on the seller, the brand of the bar, and the purchase quantity.

5. Market Demand

The overall demand for gold bars influences their price. In times of economic uncertainty, demand for gold tends to rise, driving prices higher.

6. Currency Exchange Rates

Gold is typically priced in US dollars, so fluctuations in exchange rates can affect the local price of gold bars in other currencies.

Where to Buy 200 Gram Gold Bars

There are several reputable sources where you can purchase 200 gram gold bars:

1. Authorized Bullion Dealers

Specialized bullion dealers offer a wide range of gold bars, including 200 gram options. These dealers ensure the authenticity and purity of the bars and often provide certification.

2. Banks

Some banks sell gold bars and provide a secure and trusted buying environment. However, prices might be higher due to additional premiums.

3. Online Retailers

Purchasing gold bars online is convenient and often cost-effective. Reputable online retailers offer competitive prices and secure shipping. Always verify the legitimacy of the retailer before making a purchase.

Key Considerations When Buying 200 Gram Gold Bars

1. Purity and Certification

Ensure that the gold bar comes with a certificate of authenticity, verifying its purity and weight. This certification is typically provided by recognized assayers or mints.

2. Price Comparison

Compare prices from different sellers to find the best deal. Consider the spot price, premiums, and any additional fees.

3. Reputable Sellers

Purchase from well-established and reputable sellers to ensure the quality and authenticity of your 200 gram gold bar. Research the seller’s reputation and customer reviews before making a purchase.

4. Storage Solutions

Proper storage is crucial to protect your investment. Options include:

- Home Safes: Secure and accessible, but ensure your safe is high-quality and well-concealed.

- Bank Safety Deposit Boxes: Offer high security, though access may be limited to banking hours.

- Bullion Storage Facilities: Specialized storage solutions 200 gram gold price provide top-tier security and insurance for your gold bars.

Benefits of Owning a 200 Gram Gold Bar

- Wealth Preservation: Gold is renowned for maintaining its value over time, providing a hedge against inflation and economic downturns.

- Liquidity: 200 gram gold bars are easily bought and sold in the global market, ensuring liquidity when you need it.

- Portfolio Diversification: Adding gold to your investment portfolio helps diversify and reduce overall risk.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset that you can hold and store.

Conclusion

Understanding the factors that influence the 200 gram gold price can help you make informed decisions and secure your investment. By purchasing from reputable sources, verifying authenticity, and ensuring proper storage, you can confidently invest in 200 gram gold bars. Whether you are a seasoned investor or new to precious metals, adding a 200 gram gold bar to your portfolio offers a substantial and stable asset that can help preserve and grow your wealth.